Latest Articles

Scotiabank’s E-Commerce Solution- Right For You?

Many clients ask about a ‘local e-commerce solution’ which is somewhat of a misnomer. If by local solution you mean one where online purchases are paid for in TT Dollars then there is none. If by local solution you mean one where the payment is processed right here in T&T then there is none. If by local solution you mean where you can walk into a financial institution in Trinidad & Tobago and sign up for their ‘E-commerce Solution’ notwithstanding the first two points then the answer is finally a yes.

I’ll pause for your momentary bout of elation. Had enough? Sorry, but I have to burst that bubble now. There is only one financial institution in T&T that offers an e-commerce solution and it’s Scotiabank. Since many of my clients are small businesses unfortunately it’s not for you.

I’ve been in contact with Nigel Pantin, Manager at Scotia Centre in Port of Spain who I had met sometime last year at a Scotiabank seminar, and got some facts about Scotaibank’s e-commerce service. While he applauded my efforts to share with entrepreneurs / individuals the various e-commerce options available, including the Scotiabank E-commerce solution he went on to say that, quote: “presently the target market for this service is primarily Corporate & Commercial Customers – i.e. larger organizations and not ideal for small businesses.” That’s not the kind of answer I was expecting.

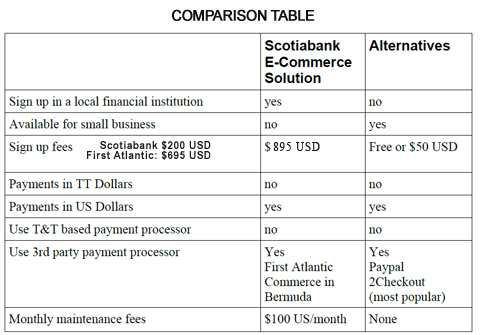

Before you feel too bad, I still obtained the details about Scotiabank’s E-Commerce solution and discovered the only local thing about it was the ability to walk into a physical location and sign up. Here is the comparison:

So where does this leave you? Exactly where you were- which means when it comes to e-commerce solutions we’re pretty much stuck with the US based ubiquitous Paypal (loved and hated by many) and the popular (in Trinidad at least) 2Checkout. Does this place you at a disadvantage? Not really in my opinion if you understand the basic premise behind an online payment. A payment processor simply collects an online payment on your behalf, with a secure connection that protects your information, keeps their transaction fee (3%-5%), then remits the balance to your bank account. [Note Paypal does not remit your funds to a T&T bank account but 2Checkout does]. Scotiabank’s solution is absolutely no different in this respect.

I also suspect that local banks are not considering implementing a truly ‘local’ solution in the short term despite the passing of the Electronic Transaction Act 2011.

IS A ‘LOCAL’ SOLUTION REALLY NECESSARY?

In my opinion only to an extent. The ability to pay online safely, securely and without hassle is really what shopper’s want, it doesn’t matter if the payment is in US or TT dollars. What online sellers want, in my opinion again, is really what Scotiabank is technically offering- though not to the small business- by having part of the relationship based in Trinidad. The real downside of Scotiabank’s solution is the high cost and limited target market.

The doors are wide open for any other local financial institution to establish a partnership with a US based payment processor and act as a local agent/facilitator. As long as the costs are not in the thousands to set up, I’m sure that local small businesses would be willing to pay for such a service and I’ll have no problem recommending such to my serious clients.

One thought on “Scotiabank’s E-Commerce Solution- Right For You?”