Getting Paypal to Work in Trinidad & Tobago- the Struggle Is Real

Since the lockdown in March, my PayPal articles, ancient as they are, (circa 2013), have experienced a resurgence like never before. I can understand the interest— Covid-19 has scared the bejesus out of every Tom, Dick and Harrilal Rampratap, and forced us to take a long hard look into to the future in what appears to be a grim, dark one. Worse yet,this pandemic is far from over.

I write this article really as a public service. My early PayPal articles were to provide answers about local E-Commerce when no payment gateways were available in Trinidad & Tobago. When First Atlantic Commerce came on the scene, it was expensive and unaffordable for smaller businesses, which kept PayPal as the only affordable option. However, with the arrival of WiPay, the point of PayPal at long last became moot, and I dropped it as an option for clients.

So if we have WiPay now, and they’ve been around for a few years well already, why are people still scouring the web and finding my dusty, old PayPal articles?

Reason number one: To get paid from US or International sources

I say reason number one because it’s the number one reason. The pandemic has forced many to look outside T&T for income producing opportunities. I’ve had specific mention of affiliate marketing programs, Ebay, Rakuten, online stock trading to name a few. These, and many other companies, require a PayPal account to send funds to.

So what’s the problem? From the comment feedback I’ve been getting in response to my articles, The issues being faced are:

(i) Issues on the sign-up side of PayPal

I get many questions about the sign-up process, specifically in regard to linking your T&T bank account and credit card with PayPal. So let me explain how it works.

When you sign up for a PayPal account you need to transfer funds you receive through it to a bank account. For US accounts, two principal methods are used:

- A bank account linked via the banks routing number

- A debit or credit card

In the US, PayPal is able to verify and connect a US bank account and debit/credit card online through their system. In Trinidad & Tobago, it is not possible to do the same with our bank accounts, but verification can be done via the debit/credit card.

Verification is done is by sending a $1.95 USD charge to your card. After the card is confirmed the amount is refunded. The charge appears on your card statement with a 4-digit code and the word PAYPAL. If you view your card statements online, you can check for the code in a few days, then update it in your account settings to confirm.

However, that is in theory as there appears to be issues with that today in 2020. Back in the day, 2011 to be exact, I signed up with PayPal using my RBC Royal Bank issued Visa credit card with no problems and have been using this account for my web design business— mainly buying templates, plug-ins etc. I also use it personally for online shopping, buying Roblux credits for my daughter and other miscellaneous things and have no problems to this day.

However, I’ve been getting reports that lately people are having trouble linking their credit cards to complete the sign up process. I’ve also been asked about the new Visa debit cards being issued by Scotiabank and JMMB. My answer to that is that it makes no difference to PayPal if the card is debit or credit as long as there is the Visa or Mastercard logo. I also want to add that these are intermittent reports, many are having success in signing up with no issue, but are complaining about the next point.

(2) Issues receiving money into PayPal

This I have personally experienced. The last time I received money through my PayPal account was also back in the day when I wrote those articles. I had jokingly put a PayPal button on one of my articles to prove it works and invited readers to buy me a cup of coffee with a small $5 USD button and believe it or not a few people actually did.

I had stopped checking after a while and only until I started getting queries about receiving payments I checked again and found that receiving money wasn’t working anymore. I had actually contacted PayPal Support about it but they only pointed me to check my settings.

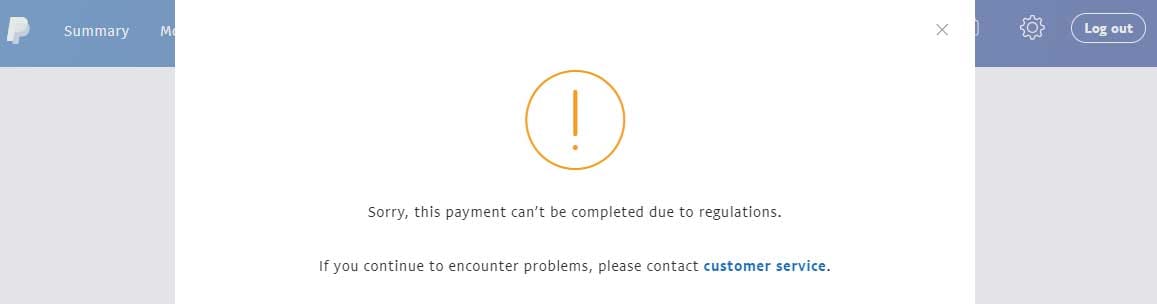

As of today, this minute as I write this, I just tried receiving a payment into my PayPal account and got this message:

Unless that error message is unique to me, that’s very telling right there. There is no glitch in the matrix, no technical problem, there reason is clearly ‘regulations’. This begged the question: who’s regulations? Well it turned out to be the ‘guavament’.

Here’s the email I got from PayPal which explained the problem:

Dear FORWARD MULTIMEDIA,

To comply with government regulations, this transaction has been declined. Unfortunately, we are not able to complete this particular transaction. This decline is specific to this transaction and does not affect the use of your PayPal account. We apologize for any inconvenience this may cause.

PayPal may be complying with US regulations or may be complying with Trinidad & Tobago’s, with one or the other restricting its ability to conduct such financial transactions. I have a strong suspicion that our country has been blacklisted by the US or worse, it may be a clandestine move from our government to prevent it. It’s open to speculation but all the ‘speculatating’ in the world won’t change a thing.

Of course there is no one here to turn to at a top, official level, say at our Ministry of Finance or Central Bank to ask for an investigation in this land of nothing works.

Reason number two: To get US Dollars

There is a mistaken belief that funds transferred from your PayPal account to your credit card when you withdraw, are in USD. This is false. Most all credit card accounts from T&T banks are denominated in TTD. Any funds transferred in, regardless of the source, would be credited in our currency.

It leaves me to wonder what happens if you actually could transfer $1,000 USD from your PayPal account to your TT credit card account. You would get the roughly $6 point something K in TTD. Does the USD evaporate into the atmosphere or does the bank keep the USD to sell to their big business friends while giving you the converted TTD? ‘Speculatating’ again…

(1) No USD to be kept if receiving funds from friends or family abroad

If your tanty or granny from the US is sending money to your PayPal account and you have high hopes of getting your hands on that USD, be reminded of what I mention above. You eh keeping nutten. To be fair to our local banks. that’s perhaps how their banking software works.

But I’m not sure if our local banks will want to facilitate this being the bloodsucking parasites they are. They’ll do everything possible to keep your USD when you transfer in, then if they don’t keep it, SELL IT BACK to you for a profit. There is nobody fighting for you, so the banks can do this with impunity.

(2) No USD to be kept from online sales with PayPal as the processor either

Same thing, doesn’t matter how the funds get into your PayPal account, from money requests to friends or family, income from third party websites like the aforementioned Rakuten, Ebay etc. or online sales via integration on your website, as long as the funds sitting in your Paypal account are withdrawn via your linked TT credit card to your account here, you’re going to get TTD.

I’ll get into some more detail on the aspect of PayPal integrated on a website for online selling below, as it warrants a full explanation.

Reason number three: As a payment processor for online stores

Renewed interest in PayPal from where I sit is NOT because merchants are looking for an online payment solution to accept credit cards on their website. WiPay, as the local PayPal alternative is very well known now and there is scarcely anyone who won’t find WiPay when they research. Remember I said in my opening that I dropped PayPal as a payment solution for online stores after WiPay became available.

What many won’t know would be the integration limitations of WiPay with E-Commerce platforms, as extensions only exist for WordPress and Magento. Non exists for DIY platforms like Squarespace, Wix etc. and so too Shopify though I’ve always heard it was in the pipeline. Not that such integration is impossible, it’s just that it would take additional development to code the extensions from scratch..

It may be that the online store DIY’ers are finding this out the hard way, then looking for solutions when they discover that their only option for those platforms are PayPal.

The fallacy of earning USD from selling online through PayPal

Merchants are always concerned about USD currency mainly about if they can earn it somehow from selling online. This is mainly due to the acute foreign exchange shortage and the desperation it’s caused. I tell them that as long as transactions originate here in T&T, they are not legitimately earning USD so have no right to any USD regardless of your site’s base currency being in USD, which it has to be in order to use PayPal as a payment method.

If you look at it objectively, if a customer from San Fernando shops on your site and pays with his locally issued credit card, what USD are you generating? He pays his credit card with TTD. So technically, the notion of using PayPal this way is an attempt to game the system.

However, if customers outside T&T shop on your site, then you ARE legitimately earning USD which you have a RIGHT to. But the system doesn’t work that way because your credit card account is in TTD. So in the rare case you get PayPal to work on your site and attempt to withdraw to your linked credit card account, it’s going to be nothing but TTD. Local banks are NEVER going to change this.

The great foreign currency leakage hoax

There is a bandwagon of tricksters and idiots peddling this hoax. guilt-tripping on all the forex leaving our shores via PayPal when used as a payment processor on online stores. Please understand that Trinidad & Tobago DOES NOT have a forex leakage problem. We have 50+ years of corrupt and incompetent governance by stink and dutty red and yellow politicians bleeding our country dry to enrich themselves, friends and financiers. All the economic structural adjustments they make, that you and I as citizens bear the brunt of daily, is to ‘correct’ their mismanagement, but only enough to keep the economy circling the drain instead of going completely down the toilet. The online tax is one such example.

So please don’t buy that garbage of foreign exchange leakage that we somehow are responsible for when we import billions in USD in food. In 5 years our agriculture minister hasn’t found one food item that we could have been self sufficient by now, nor any before him.

When billions of USD are wasted on government projects without consequence, the answer is for the small man to beg for $500 USD from his bank and do his civic duty. In some words you may have heard before, MISS ME WITH THAT BULLSHIT.

Solutions to the PayPal struggle

Unfortunately there are NO options to make it work the way it should as long as the ‘regulations’ are in effect. We remain at the mercy of these regulations until they are changed and doing transactions the regular way becomes kosher. All I can recommend are workarounds, which are not pretty or straightforward, but when you’re grasping at straws— desperate times, desperate measures…

(1) Open a personal US bank account

I’m no expert in this area this is just from the knowledge I have. Theoretically it’s possible. There are two main elements: (1) you need to have a physical US address and (2) there’s a requirement for a form called W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). The bank will need to be filled at the bank you’re applying to. Some banks may ask for a reference from a T&T bank.

If you have relatives in the US, and most of you do, I recommend you have them accompany you to their bank and inquire about the process in person. It’s not against the law for a foreign person to open an account, you just have to follow the procedure. However, at this time with the pandemic, with the Covid-19 situation getting worse in the US, and especially in places where we have the concentration of Trinis like New York, Florida and Texas, this option is not currently feasible.

(2) Use a relative's US bank account

This is also not illegal but would have some implications. For example if you’re selling on Ebay you’ll need your relative to open the account. However this will have tax implications and other issues that puts any liability on that person. I don’t know that many will want to do that, they would have to love you real bad. And for some they might be willing, as they say, to do anything for you, but won’t do that. And I’m sure you wouldn’t want to out them through that anyway.

(3) Set up a US company

Notwithstanding the red tape and tax implications in both US and TT jurisdictions, I know there are companies who’ve done this. Yes it’s extreme and you have to want it real bad. However, I know of examples where a US business was set up and business bank accounts opened but when it was observed that business was being done from only T&T it raised a red flag with the US bank.

(4) Forget PayPal completely for online stores

We have WiPay, FAC, CX Pay. For local and Caribbean online stores, there is NOTHING MISSING that PayPal is needed to fill the void. Stay away from DIY website builders like Wix, Squarespace for your online store unless you plan to send customers WiPay links to get payment as no integration is possible at this time. There’s an FAC plug-in for Shopify from one of my competitors but it’s too expensive to make financial sense. My advice: stick with WordPress and avoid the headache.

(5) Vote out this government

Everything that’s wrong with our systems in Trinidad & Tobago are as a result of the piss-poor governance since independence. I’m not being political, and I want to speak directly to you young people under 30 who are reading this, which are many of you. This includes my son who turns 21 this month (July) who I give the same advice.

Trinidad & Tobago is a tiny speck of of an island with 1.3 million people. At roughly the size of Rhode Island (1,214 sq miles, population 1.1m, Trinidad: 1,864 sq miles), still in the world scale of things we’re the size of a municipality. The city of New York alone is 8 million people with 2.2 million in the borough of Queens. compare that with our borough of Chaguanas.

With the natural resources we have, oil and gas, pitch lake, sun, sand and sea, we’ve descended into this shithole— yes I said it, that we’re currently from poor governance from day one. There is literally NO EXCUSE for our current condition other than corrupt and incompetent governments that we exchange every five years. Rowley is bad yes, but Kamla is exactly the same, two sides of the same coin.

Do yourself a favor this time and think about your future. The red and yellow parties are the problem, not the solution. And those who think they are, have no intelligence. You can’t expect to put Kamla-Ma back and get different results. Neither of them gives a rat’s ass about our welfare.

I’ve driven on roads that haven’t been fixed in her five years and Rowley’s five years which make it 10 years the roads haven’t been touched. One shut down Caroni to import sugar, the other shut down Petrotrin to import gas. Both say that the companies were not profitable and so packed them up like a vegetable stall on the side of the road. To them it makes perfect sense to let fresh water falling miraculously from the sky go to the sea then take it back to remove the salt. I could go on.

And don’t compare the size of the crumbs you get while they both gorge at the table. We deserve better, and there is a third party now that should be given the opportunity. Believe me, no one can do worse than what we got already.

Conclusion

There you have it, my latest treatise on PayPal and a little rant (being my blog and all) and I hope it was helpful. Please share your experience so I may update as necessary. It seems that everyone are encountering different results.

I try to respond to all the emails, phone calls and comments as long as I have time, but I’m sure you can appreciate that I’m way busy these days as this pandemic has raised the profile of online in T&T like never before. In fact, I can say without doubt that we’ve skipped a few steps of growth than if we had to wait to grow organically. And also without doubt, even after Covid-19 we will never go back to the way it was, we will keep moving forward from here. That’s why I’m Forward Multimedia…

I want to do it

Thanks for your detailed information on PayPal. It is helpful. The new banking regulations adopted in 2012/3 also affected bank accounts.

Thanks for the info.